There are some fascinating insights to share from the latest Zonda’s New Home Market Update that sheds light on the resilience of new-home sales despite high mortgage rates.

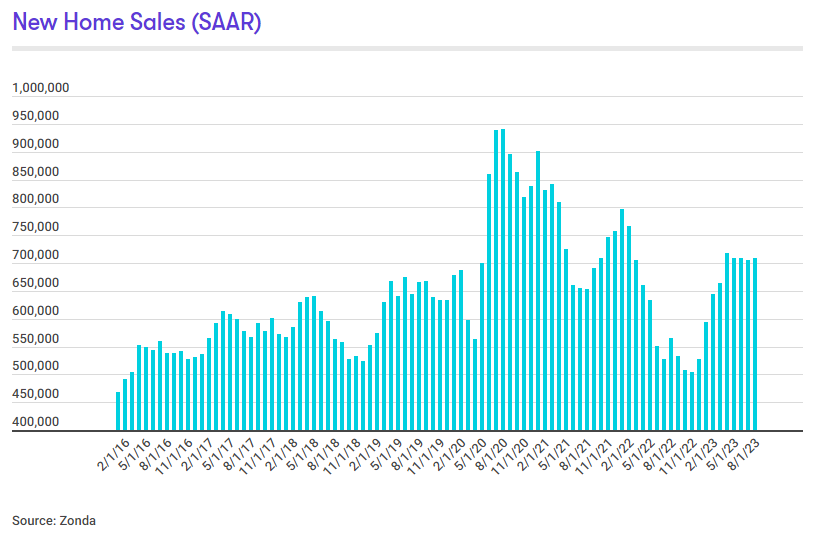

Despite mortgage rates surpassing 7%, the data shows an impressive 25.6% year-over-year increase in new-home sales.

Interestingly, Zonda’s New Home Pending Sales Index, which accounts for fluctuations in supply by combining total sales volume with the average sales rate per month per community, has increased 37.1% from the same month last year.

Cities like Phoenix, Sacramento, and San Francisco have performed exceptionally well compared to last year. However, on the flip side, markets such as Jacksonville, Florida, Baltimore, and New York have not fared as well.

National home prices have seen an increase across all products, ranging from 0.2% for entry-level homes to 3.9% for high-end homes. In August, 37% of builders reported raising prices, while 58% reported holding prices flat.

The report also found that 58% of new-home communities were offering incentives in August. The lack of competition from other new-home communities is allowing for some upward pressure on the average sales rate per month per community.

In terms of community count, Austin, Texas, Minneapolis, and Riverside/San Bernardino, California saw the most growth year over year. On the other hand, Tampa, Florida, Seattle, and Las Vegas saw a decrease compared with last year.

Lastly, national quick move-ins (QMIs) are down 9.4% compared with last year but are 80.5% above the 2019 levels. Markets such as Los Angeles/Orange County, Salt Lake City, and Las Vegas have seen the most growth in QMIs.

- This resilience can be attributed to five key factors:

- Limited quality competition from the resale market.

- The use of incentives by builders, especially mortgage rate buydowns.

- A narrowing of the price spread between new and existing homes.

- The market's growing share of cash buyers is unfazed by rising rates.

- A begrudging acceptance from consumers that low-interest rates are a thing of the past.

- What can you do?

This resilience can be attributed to five key factors:

Limited quality competition from the resale market.

The resale or existing home market is currently experiencing a significant inventory crunch. There are simply not enough homes available to meet the demand from buyers. This shortage is due to a variety of factors, including homeowners choosing to stay in their homes longer, a slowdown in new construction due to supply chain disruptions and labor shortages, and investors buying up properties for rentals or flips.

Moreover, the quality of available homes in the resale market may not match up to the expectations of today’s discerning homebuyers. Many resale homes might require renovations or upgrades, which can add to the overall cost and inconvenience for the buyer. On the other hand, new homes are built with the latest designs, efficiencies, and technologies that cater to modern lifestyle needs.

Therefore, despite high mortgage rates, new homes are becoming an increasingly attractive option for many buyers, leading to robust sales in the new-home market. The limited competition from the resale market essentially paves the way for new home builders to capture a larger share of the market.

The use of incentives by builders, especially mortgage rate buydowns.

In a high mortgage rate environment, builders often use incentives such as mortgage rate buydowns to make new homes more affordable and attractive to potential buyers. A mortgage rate buydown is when the builder or seller contributes funds to lower the buyer’s mortgage interest rate for a certain period, reducing the monthly payment and making the home more affordable.

For example, if the current market rate is 7%, a builder might offer a 5% rate for the first year and a 6% rate for the second year before the loan adjusts to the 7% rate. This can save the homeowner thousands of dollars in interest over the first few years of homeownership, making the purchase more manageable and appealing.

A narrowing of the price spread between new and existing homes.

The price spread between new and existing homes refers to the difference in cost between buying a newly constructed home versus purchasing an existing or resale home. Traditionally, new homes have been more expensive than existing homes due to the costs associated with land development, construction, and the inclusion of modern amenities and technologies.

However, in today’s market, this price gap is narrowing. A few factors contribute to this:

- Increased Prices of Existing Homes: The prices of existing homes have been rising due to high demand and low inventory. This increase has brought the cost of existing homes closer to that of new homes.

- Cost-Efficiency of New Homes: New homes often come with energy-efficient appliances, better insulation, and other modern features that can lead to long-term savings on utility bills. These cost savings can offset the initial price difference.

- Less Maintenance and Renovation: New homes typically require less maintenance and renovation compared to older homes, which can result in additional savings.

As the price spread narrows, potential buyers might find new homes to be a more attractive option given their modern features, energy efficiency, and lower maintenance needs. Even though mortgage rates are high, the overall value proposition of new homes has improved due to the narrowed price spread, thereby helping to sustain strong sales in the new-home market.

The market’s growing share of cash buyers is unfazed by rising rates.

Cash buyers are typically unaffected by rising mortgage rates because they do not require a mortgage loan to purchase a property. They can bypass the entire lending process, making the home-buying process faster and more straightforward. Because they are not subject to lender approval, they can often close deals quicker, making their offers more attractive to sellers.

According to a report from Business Insider, about a third of all homebuyers are paying cash, representing the highest share in a decade. This trend is helping to sustain the real estate market despite the challenges posed by higher mortgage rates.

As for why more people have the cash to buy houses, several factors could be contributing to this trend:

- Wealth Accumulation: Over the past few years, there has been significant wealth accumulation among certain demographics due to the strong stock market performance, booming tech sector, and other factors. Some individuals may be using this accumulated wealth to purchase homes outright.

- Downsizing or Rightsizing: Some cash buyers may be individuals who are downsizing from a larger, more expensive property. They might use the proceeds from the sale of their previous home to buy a smaller one in cash.

- Investment Strategy: Real estate is often viewed as a stable investment, especially in times of economic uncertainty. Some individuals or companies may choose to invest their cash in real estate as a strategy to diversify their portfolio.

- International Buyers: In some markets, international buyers contribute significantly to the pool of cash buyers. These individuals often have the means to purchase properties outright, particularly in desirable locations.

- Real Estate Investors: Some cash buyers are real estate investors who buy properties to renovate and resell or rent out. They often prefer to pay in cash to close deals quickly.

A begrudging acceptance from consumers that low-interest rates are a thing of the past.

In the post-recession era, consumers have enjoyed a period of historically low interest rates. These low rates have made borrowing cheaper, driving up demand for credit and stimulating economic activity. They have particularly benefited the housing market, where they have enabled more people to afford mortgages and thus fueled a boom in home buying and construction.

As economic conditions improve, central banks often raise interest rates to keep inflation in check. When this happens, consumers may initially resist the change, especially if they’ve become accustomed to low rates. However, over time, they may begrudgingly accept higher rates as the new normal.

This acceptance can lead to several outcomes:

- Adjustment in Spending Habits: As borrowing becomes more expensive, consumers may cut back on their use of credit for big-ticket items like cars, homes, or major appliances. This could slow down sales in these sectors but could also encourage more prudent spending and saving habits.

- Shift in Investment Strategies: Investors might shift their strategies to align with the higher interest environment. For example, they might move funds from equities to bonds or other fixed-income securities that benefit from higher rates.

- Impact on the Housing Market: In the housing market, consumers might opt for smaller or less expensive homes that they can afford with higher mortgage rates. Alternatively, they might choose to rent rather than buy until they can afford a mortgage.

- Economic Balancing: While higher interest rates make borrowing more expensive, they are typically signs of a healthy, growing economy. They can prevent the economy from overheating and keep inflation in check, contributing to long-term economic stability.

- Increased Savings: Higher interest rates could incentivize savings as the returns on savings accounts and other interest-bearing assets increase. This could lead to an overall increase in the national savings rate, which could be beneficial for the economy in the long run.

While the acceptance of higher interest rates can lead to short-term adjustments and potential discomfort for consumers, it is a necessary part of economic cycles and can contribute to long-term economic health and stability.

What can you do?

Home designers can play a crucial role in this scenario by creating homes that are not only aesthetically pleasing but also efficient and cost-effective. They can focus on designing homes that optimize space usage, incorporate energy-efficient technologies, and meet the lifestyle needs of modern buyers. Such features can increase the perceived value of new homes, making them more competitive despite high mortgage rates.

Moreover, home designers can work closely with builders to create customizable home options or upgrade packages. Offering buyers the ability to personalize their homes can be a strong selling point, especially when combined with financial incentives like mortgage rate buydowns.

If you’re not already, reach out to builders to offer your services. Using the point above, express the finer points that highlight how your services can benefit them. Prepare a professional presentation or proposal outlining your services, experience, and the value you can bring to their projects. This proactive approach can help you form valuable partnerships and secure contracts.

Promote your business on social media and other online platforms. In today’s digital age, having an online presence is crucial for businesses. Use social media platforms like Facebook, Instagram, LinkedIn, and Twitter to showcase your services, share customer testimonials, and post pictures of your work. Additionally, consider investing in a professional website and using SEO techniques to increase your visibility on search engines. Online advertising through Google Ads or social media ads can also help you reach a wider audience.

Attend industry events to network with potential clients. Industry events like trade shows, expos, and conferences provide excellent opportunities to meet potential clients and other industry professionals. Be prepared with business cards, brochures, or even a portfolio of your work. Engage in conversations, show genuine interest in others’ work, and follow up after the event to foster relationships.

Offer incentives to buyers, such as free consultations. Although we typically have hated this idea when it comes to home design, incentives can be a powerful tool to attract new customers. Consider offering free initial consultations, discounts on materials, or special packages. These offers can make your services more attractive and give potential clients an extra reason to choose you over competitors.

Building a successful business involves consistent efforts and strategies tailored to your unique services and target audience.

By implementing these strategies, you can increase your visibility, attract more clients, and grow your business in the competitive market.

The changing landscape of the residential design industry presents numerous opportunities for professionals in the field.

Whether it’s through refining your design skills, expanding your professional network, or leveraging digital platforms, every step you take can contribute to your growth and success.

Stay tuned for more updates, and feel free to share your thoughts on these trends. Let’s continue to navigate these dynamic times together.

If you’re a residential designer aiming to broaden your reach and connect with potential clients, consider joining our online listing at SearchHomeDesigners.com.

Our platform is not just a place to showcase your unique design specialties to an audience actively seeking residential design services. By joining us, you’ll get access to discounted and free education, credentialling, business coaching, and the opportunity to collaborate with other industry professionals.

If you haven’t already, we invite you to join SearchHomeDesigners.com today.

We eagerly await your presence in our growing community!